How to Draw a Price Line Markets

Shabbir Kayyumi

Narnolia Financial Advisors

Basics of Technical Analysis: Part 6

Trendlines are an important tool in technical analysis for both trend identification and confirmation. One of the basic tenets put forth by Charles Dow in the Dow Theory is that stock prices moves in a trend. Trends are often measured and identified by "trendlines".

These trend lines can help us to identify potential areas of increased supply and demand, which can cause the market to move down or up respectively. Trend lines can help traders identify buying and selling opportunities that occur within a strong trend.

Types of Trendline

A trend line is a straight line that connects two or more price points and then extends into the future to act as a line of support or resistance.

Trendlines are classified into two major types:-

1) Support Trendline

Figure .1 Support trendline (Nifty taking support from trendline)

As shown above, yellow trendline is drawn by touching point 1 and point 2, and after extending the straight line we could see that Nifty prices have taken support further from it from point 3 & 4. This was an opportunity of buying which turned out to be in line as indicated.

2) Resistance Trendline

Figure .2. Resistance trendline (Dr Reddy's stock taking resistance from trendline)

It is clearly seen from above chart that every time prices of Dr Reddy's Labs are approaching towards red resistance line, they are facing resistance. After taking resistance from point 3, 4& 5 prices are trading lower.

Drawing Trendline

Trendline is formed when a diagonal line can be drawn between a minimum of two or more price swing points or pivot points. It is also called as a sloping line which can be drawn on a chart by connecting two or more points.

Trendline will have three points:-

Initiating Point (1): First point from where the line starts and used for initiation. The very first thing to know about drawing trend lines is that you need at least two points in the market to start a trend line.

Confirming Point (2): Second point or point 2 which confirms the straight line after connecting with a point 1. Once the second swing high or low has been identified, you can draw connecting trend line.

Validating Point (3): Third point is important and it confirms the validity of the trendline. Two points is speculative, three points confirms- It's important to note that any two reference points can offer a trendline- however it's the third touch point that confirms the validity of the slope. Therefore before relying too heavily on a given gradient, look for that third touch point for conviction.

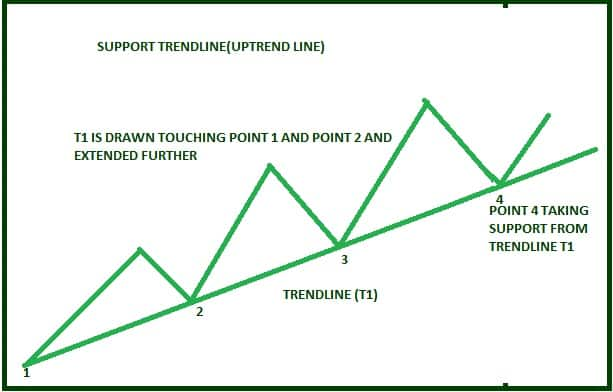

Figure .3. Support Trendline

Above figure explains about support trendline, and how point 3 has validated trendline drawn from point 1 & 2. It also indicated how point 4 has taken support from trendline. However point 4 has acted as a good buying opportunity, suggesting how trendline provides support and prices bounce back by touching them.

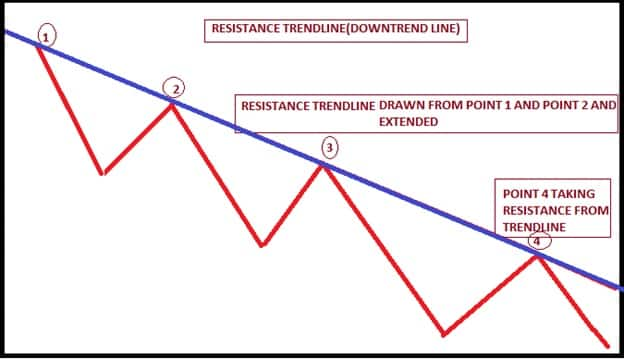

Figure .4. Resistance Trendline

We have mentioned above about resistance trendline, which can be drawn in similar way however generally prices take resistance from point 3 & 4and trades lower. Looking at attached chart blue trendline is drawn by connecting point 1 & point 2. And further ahead point 3 and point 4 have taken resistance from blue trendline, which has given selling opportunity.

Important aspects of Trendline

Some important aspects to keep in mind while studying trendlines:

1• As long as the price action stays above this line, we have a bullish trend. Lines with a downward slope act as resistance to the price action. As long as the price action stays under this line, we have a bearish trend.

2• Trend of higher time frame rules over the trend of lower time frame. If the trend in higher time frame is up then down trend in lower time frame might be a counter trend of uptrend and vice versa. So a trade taken in the direction of higher time frame is more profitable.

3• Most trend lines one come across will have some overlap from the high or low of a candle, but what's important is getting the most touches possible without cutting through the body of a candle.

4• Line chart: On a long-term chart, trendlines drawn with closing price are more effective. It is used for breakout and can be used on all types of charts.

5• A break of a trendline should fuel acceleration- When a slope is broken as resistance or support, the subsequent move should see prices follow through in the direction of the break. If prices break and fail to accelerate in that direction, often times this will be a sign of a 'false break out' scenario (also known as a 'throw-over').

6• Flipping characteristics: Once the line is broken support becomes resistance and resistance becomes support.

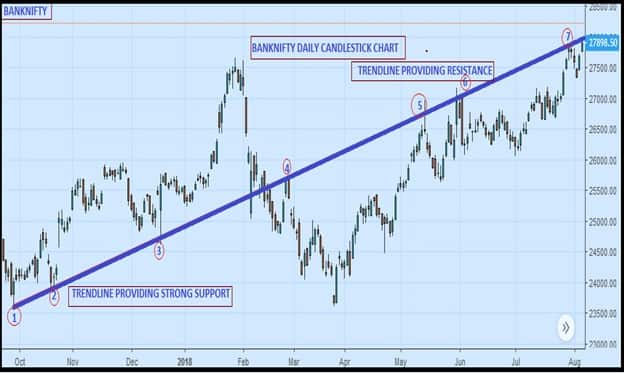

Figure .5 Support Trendline becomes resistance trendline( Banknifty )

Conclusion

1• Think of trendline as the diagonal equivalent of horizontal support and resistance.

2• They can also be used as support and resistance and provide opportunities to open and close positions.

3• Draw trendlines through the lows of an up-trend — and through the highs of a down-trend.

4• On long-term charts, drawing trendlines through closing prices would give better results.

5• Trendlines must be respected by at least three lows (or highs in a down-trend) — if respected twice, the trendline is not yet confirmed.

Disclaimer: The author is Head - Technical & Derivative Research at Narnolia Financial Advisors. The views and investment tips expressed by brokerage houses on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

How to Draw a Price Line Markets

Source: https://www.moneycontrol.com/news/business/markets/technical-classroom-how-to-draw-trendlines-to-indentify-support-resistance-on-stock-charts-2929401.html

0 Response to "How to Draw a Price Line Markets"

Publicar un comentario